Income Tax Rebate 2025-26 Unbelievable. If assessee wants to opt out of. Income tax relief in 2025:

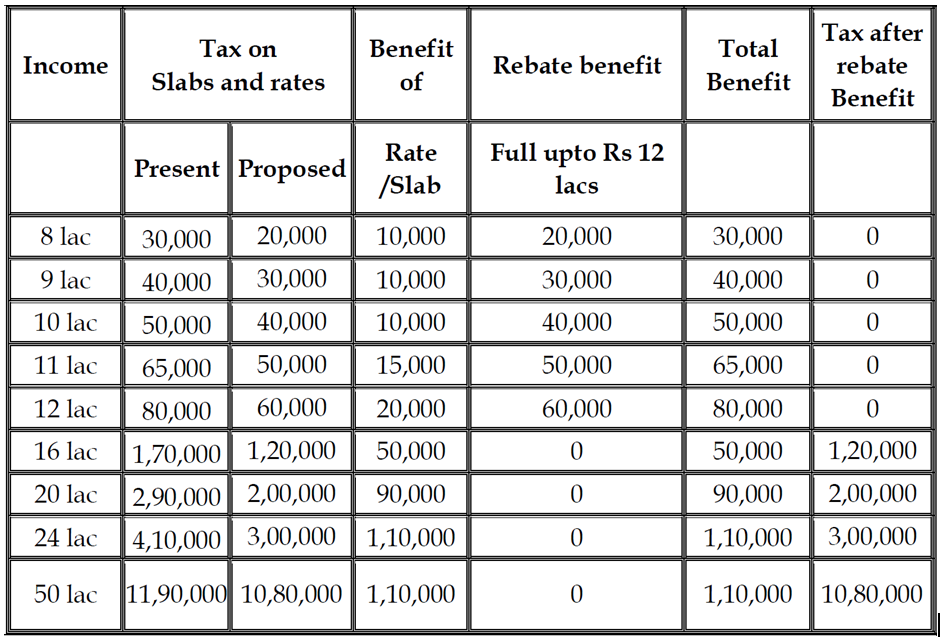

60,000 is allowed under the new regime for an income up to rs. Income tax relief in 2025: Section 87a reimburses indian taxpayers earning less than specific criteria under the income tax act.

Source: www.youtube.com

Source: www.youtube.com

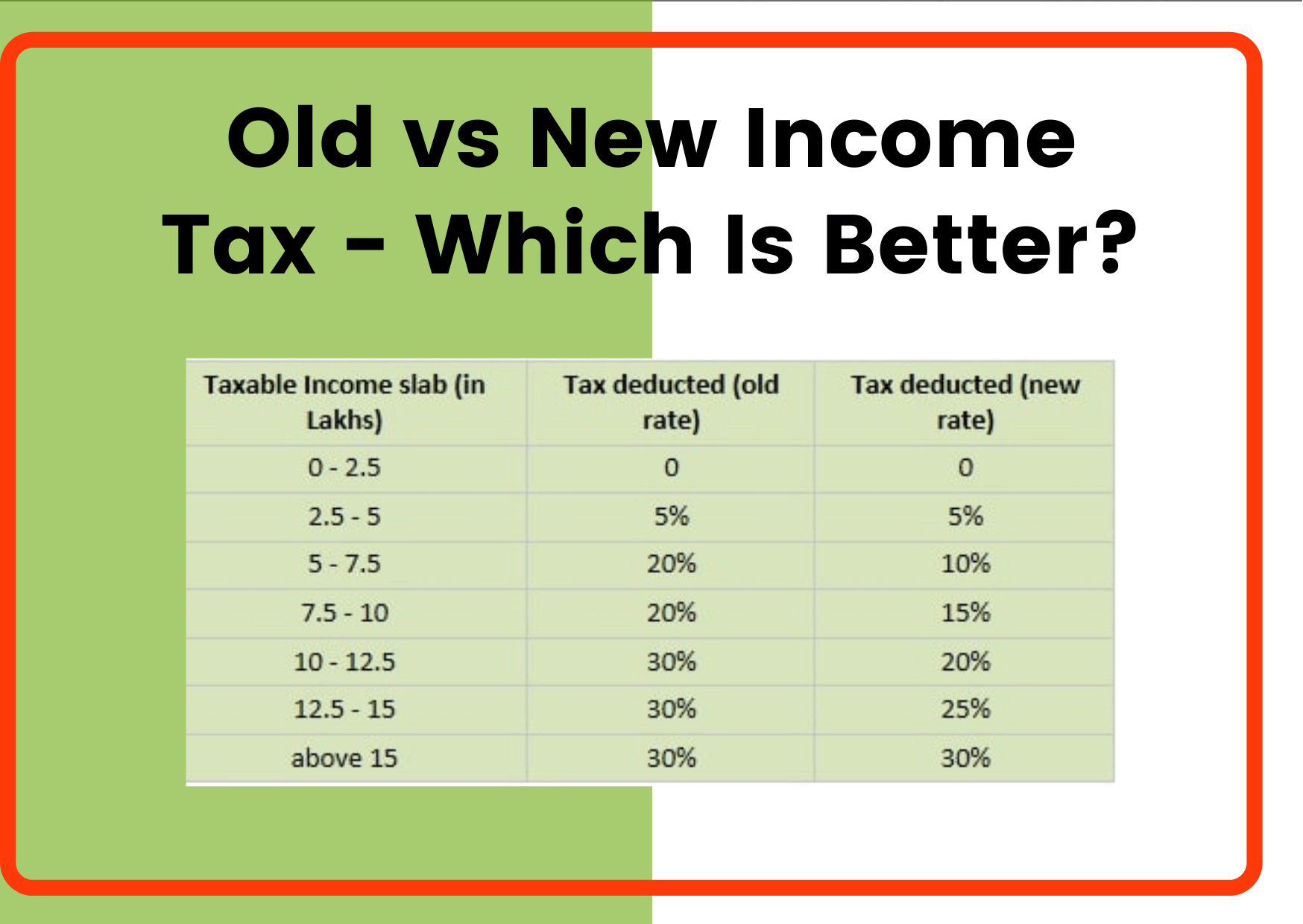

New tax slab rates FY 202425(AY 202526) in Budget 2024 of Modi The finance minister has announced an increase in the tax rebate under section 87a to rs 60,000 from rs 25,000 under. Section 87a reimburses indian taxpayers earning less than specific criteria under the income tax act.

Source: eroppa.com

Source: eroppa.com

New Tax Slab Rates Fy 2024 25 Ay 2025 26 By Budget 2024rebate U The finance minister has announced an increase in the tax rebate under section 87a to rs 60,000 from rs 25,000 under. 60,000 is allowed under the new regime for an income up to rs.

Source: mariajdeloach.pages.dev

Source: mariajdeloach.pages.dev

Tax Rebate 2025 Trending Maria J Deloach In case of eligible taxpayers having income from business and profession, new tax regime is default regime. It allows them to claim a rebate on their tax liability.

Source: fincalc-blog.in

Source: fincalc-blog.in

Tax Calculator FY 202526 Excel download Archives FinCalC Blog It allows them to claim a rebate on their tax liability. 60,000 is allowed under the new regime for an income up to rs.

Source: www.taxhelpdesk.in

Source: www.taxhelpdesk.in

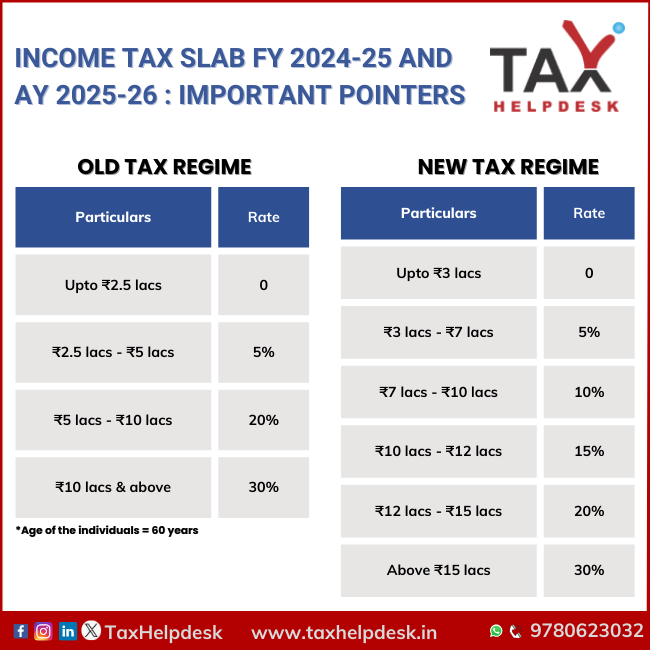

Tax Slab Archives TaxHelpdesk 60,000 is allowed under the new regime for an income up to rs. Section 87a was introduced to offer tax relief to individual taxpayers.

Source: indianexpress.com

Source: indianexpress.com

Tax Slabs Budget 2025 LIVE Updates New Tax Slab and 60,000 is allowed under the new regime for an income up to rs. The finance minister has announced an increase in the tax rebate under section 87a to rs 60,000 from rs 25,000 under.

Source: sracademyindia.com

Source: sracademyindia.com

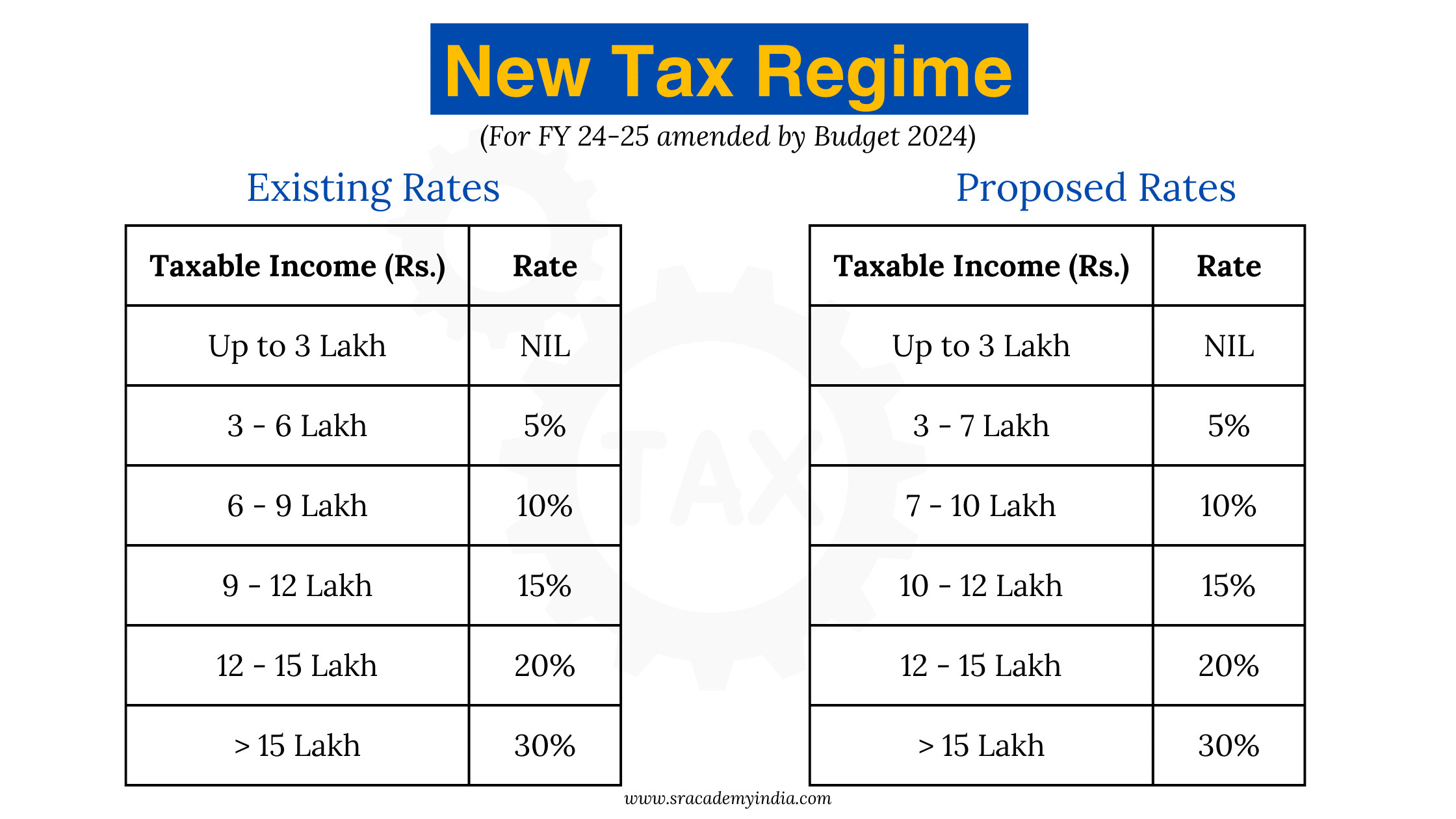

New Tax Regime changes in Budget 2024 SR Academy India In case of eligible taxpayers having income from business and profession, new tax regime is default regime. Income tax relief in 2025:

Source: moneyexcel.com

Source: moneyexcel.com

Budget 2025 Tax Slab FY 202526 60,000 is allowed under the new regime for an income up to rs. Section 87a was introduced to offer tax relief to individual taxpayers.

Source: www.youtube.com

Source: www.youtube.com

New Tax Slab Rates FY 202425 (AY 202526) by Budget 2024Rebate Income tax relief in 2025: If assessee wants to opt out of.

Source: www.caclubindia.com

Source: www.caclubindia.com

Budget 202526 No Tax on Annual Upto Rs. 12 Lakh Under In case of eligible taxpayers having income from business and profession, new tax regime is default regime. Section 87a was introduced to offer tax relief to individual taxpayers.

Source: studycafe.in

Source: studycafe.in

Tax Rebate under Old and New Tax Regime for FY 202526 It allows them to claim a rebate on their tax liability. If assessee wants to opt out of.

Source: sracademyindia.com

Source: sracademyindia.com

Tax Rates for AY 202526 SR Academy India Section 87a reimburses indian taxpayers earning less than specific criteria under the income tax act. In case of eligible taxpayers having income from business and profession, new tax regime is default regime.